How Much Is He Worth?

Determining the precise net worth of Damon Dash is challenging due to the complexities of valuing various assets and investment portfolios. Publicly available financial information on individuals, particularly those not directly involved in the public markets, is often limited. Financial disclosures, if available, may not comprehensively reflect the full scope of assets and liabilities.

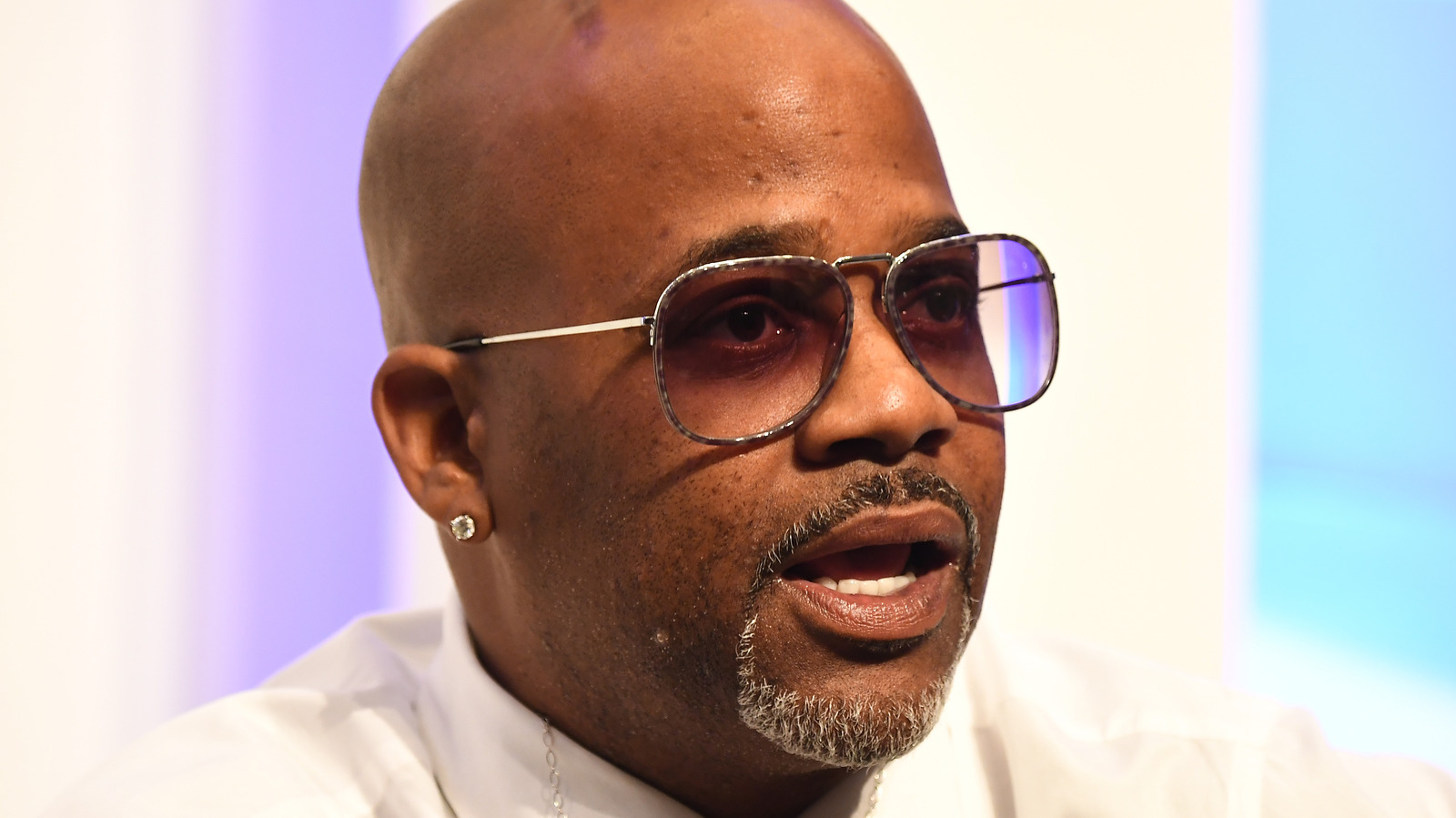

Public interest in an individual's financial standing often stems from their significant contributions to a particular industry or field. Damon Dash's role in the entertainment and business world, specifically in the music industry and ventures like Roc-A-Fella Records, provides context for public curiosity regarding financial details. The value of Damon Dash's holdings, including intellectual property, real estate, and potentially other investments, contributes to the overall discussion of wealth accumulation in these sectors. The lack of a precise figure can lead to varied estimations and speculation.

This information is presented to provide a broader understanding of the factors influencing estimations surrounding an individual's financial status and the importance of understanding the limitations of publicly available data. Further exploration into Damon Dash's career and business activities could lead to deeper insight. Subsequent sections of this article may delve into the history of the individual's investments, ventures, and notable achievements.

How Much Is Damon Dash Worth?

Determining Damon Dash's net worth necessitates a careful consideration of various factors, including his investments, income sources, and liabilities. Accurate valuation is challenging, owing to the complexity and privacy surrounding such financial matters.

- Assets

- Investments

- Income

- Liabilities

- Valuation

- Estimation

- Public Record

- Privacy

Accurate estimations of net worth rely on comprehensive data encompassing assets like real estate, intellectual property, and other investments. Income sources, from business ventures to past earnings, are also crucial. Liabilities, such as debts or outstanding obligations, must be subtracted from the total value of assets and income to arrive at a true net worth. Valuation methods, often used by financial analysts, are diverse and sophisticated, reflecting the intricacies of assessing various holdings. Estimating without detailed financial information leads to approximations. The public record often provides limited insight, leaving substantial portions of the picture obscured by privacy considerations. This ultimately impacts the accuracy and reliability of any estimation of Damon Dash's worth.

1. Assets

Assets are crucial to understanding net worth. The value of an individual's assets directly influences the overall calculation of their worth. Damon Dash's assets, encompassing various holdings, are a key component in determining the total value, including but not limited to real estate, intellectual property (like ownership stakes in businesses or music catalogs), and other investments. The combined worth of these assets significantly impacts the estimation of his overall financial standing.

Real-life examples illustrate the impact of assets on financial evaluations. Consider a business owner with a significant building valued at several million dollars. This property represents a considerable asset, substantially influencing the owner's net worth. Similarly, ownership of successful brands or significant shares in profitable companies represents a substantial asset class. The market value of such assets fluctuates, impacting the perceived worth. The more valuable the assets, the higher the potential net worth. Conversely, limited or depreciating assets lower the perceived worth.

Understanding the connection between assets and net worth is essential for evaluating financial standing. Public knowledge of an individual's assets allows for estimations of their wealth. However, challenges arise from the difficulty in accurately valuing specific assets, particularly those not readily traded in public markets, like unique investments or intellectual property. The complexity of evaluating various asset types underscores the limitations of readily available public estimations of net worth. Ultimately, understanding assets in the context of determining net worth allows for a more complete picture of an individual's financial situation, while recognizing the inherent limitations of such assessments.

2. Investments

Investments play a significant role in determining an individual's net worth. The value of investments held by an individual, like Damon Dash, directly impacts the overall calculation. Successful investments add to the total value of assets, while losses or poorly performing investments can reduce net worth. Understanding the nature and performance of these investments is critical for estimating the overall financial position.

- Types of Investments

A comprehensive understanding of the types of investments an individual holds is essential. This could include stocks, bonds, real estate, or other ventures. The value of each investment type fluctuates based on market conditions and performance. Diversification across various investment classes, a common strategy, mitigates risk. The return on investment, whether positive or negative, substantially impacts the overall valuation of the individual's financial portfolio. For example, a successful venture capitalist with profitable investments in technology startups will likely have a higher net worth compared to someone with investments in less successful industries.

- Performance of Investments

Investment performance directly correlates to net worth. Positive returns from investments increase the overall valuation of assets, while losses decrease it. Market conditions significantly influence investment performance. Economic downturns, for instance, can lead to losses in various sectors, affecting the overall valuation. Understanding the historical performance of investments provides context for assessing the current value and future potential. For example, an investment in a rapidly growing technology sector may yield high returns, while a traditional banking sector investment might show more stable, but potentially lower, returns.

- Investment Risk Tolerance

Investment choices often reflect an individual's risk tolerance. Individuals with a high tolerance for risk might invest in more volatile assets, potentially seeking higher returns. Conversely, those with lower risk tolerance might opt for more stable investments with lower potential returns. Understanding risk tolerance helps contextualize the investment choices and their impact on the overall net worth valuation. An individual heavily invested in emerging technology might exhibit a high-risk tolerance compared to one focusing on established, more traditional investments.

In conclusion, investments are a key component of calculating net worth. The types of investments, their performance, and associated risk tolerance provide crucial information for evaluating financial standing. By considering these aspects, a more complete understanding of how investments influence an individual's overall net worth becomes apparent. This understanding is vital to evaluating the overall financial picture presented by an individual's investments and their impact on the overall financial situation.

3. Income

Income directly influences an individual's net worth. A significant income stream contributes to a higher net worth, as income generates funds to increase assets or reduce liabilities. Conversely, lower or inconsistent income can hinder the growth or even erosion of net worth. The nature of income, its stability, and regularity are crucial components in understanding overall financial standing. For example, a highly paid professional with consistent income can accumulate significant assets over time, whereas an individual with intermittent or low-paying employment might struggle to build or maintain wealth.

Income sources are diverse. They encompass salaries, wages, investment returns, royalties, and other forms of revenue. The impact of each source on net worth varies. A steady salary, for example, provides a predictable and reliable income stream for building wealth. Conversely, volatile income sources, such as project-based work or freelance contracts, can present challenges in maintaining consistent financial stability. An entrepreneurs income can be particularly unpredictable, dependent on the success and profitability of their venture. The importance of understanding the nature and consistency of income sources is essential in assessing an individual's financial standing. Reliable, high-income streams enhance net worth accumulation.

The relationship between income and net worth is multifaceted. Income is a primary driver of wealth accumulation. However, expenses and financial obligations must be factored into the equation. Even with a high income, substantial expenses can limit the growth of net worth. Strategic spending and effective financial management are critical for maximizing the positive impact of income on overall financial health. Recognizing the link between income and net worth is crucial for understanding how financial decisions, income generation strategies, and expense management contribute to financial well-being. Analyzing this connection reveals how income directly translates to wealth accumulation and influences the overall financial picture.

4. Liabilities

Liabilities represent financial obligations owed by an individual. Understanding these obligations is crucial for a complete picture of net worth. Subtracting liabilities from assets reveals net worth, the true measure of financial standing. For Damon Dash, as with any individual, liabilities directly impact the calculation of how much he is worth.

- Types of Liabilities

Liabilities encompass various financial commitments. These can include loans, mortgages, outstanding credit card balances, business debts, and legal judgments. The nature and extent of each liability significantly affect the overall net worth calculation. For instance, a substantial mortgage on a property is a significant liability that reduces the net worth associated with that asset.

- Impact on Net Worth

Liabilities directly reduce net worth. The value of assets is diminished by the amount of outstanding debt. For example, a valuable property burdened by a substantial mortgage has a reduced net worth compared to the same property without a mortgage. Consistent high-level liabilities can significantly hinder the growth of an individual's financial standing and potentially create negative equity. A careful analysis of liabilities is crucial for a realistic evaluation of net worth.

- Valuation of Liabilities

Accurate valuation of liabilities is essential. Precise figures for amounts owed, interest rates, and repayment schedules are necessary for a comprehensive calculation. Missing or inaccurate information regarding liabilities will produce an inaccurate estimate of net worth. For complex financial situations, professional financial analysis might be needed. This step allows a comprehensive picture of the full financial obligations and their impact.

- Impact on Investment Decisions

Liabilities can influence investment decisions. Individuals with substantial liabilities often have less disposable income for investment opportunities. High-interest debt obligations, for instance, can absorb a significant portion of available capital, making it difficult to allocate funds towards potentially more lucrative investments. This can significantly impact future accumulation of wealth. The relationship between liabilities and investment decisions highlights the interplay between debt, investment potential, and financial health.

In conclusion, accurately evaluating liabilities is fundamental for understanding "how much is Damon Dash worth." This process necessitates a detailed examination of debt types, their respective valuations, and their impact on overall financial standing. Considering liabilities alongside assets, income, and expenses provides a comprehensive view of financial health, enabling a more nuanced understanding of the overall financial picture. Precise assessments of these components provide a clearer perspective of the true financial status.

5. Valuation

Determining the worth of Damon Dash, like any individual, hinges on valuation. Accurate valuation considers various factors, including assets, investments, income streams, and liabilities. The process is complex and often requires sophisticated methodologies. This section explores key aspects of valuation relevant to assessing Damon Dash's financial position.

- Asset Valuation Methods

Valuing assets is a critical component. Different assets, like real estate, intellectual property, or stocks, require distinct valuation methods. Real estate valuation often considers comparable sales, appraisal methodologies, and market trends. Intellectual property, such as music catalogs or business ownership, might involve discounted cash flow analysis or comparable transactions in the relevant market. Stocks are valued using market price data, publicly available financial reports, and fundamental analysis. The chosen method impacts the overall valuation estimate significantly. Inaccurate or inappropriate valuation methods will lead to misrepresentation of the true worth.

- Investment Portfolio Evaluation

An individual's investment portfolio significantly impacts net worth. Investments in stocks, bonds, or other financial instruments necessitate analysis to determine their current market values. The performance of these investments, past returns, and future projections (if available) are critical factors. Complex investments might require specialized expertise for accurate assessment. For instance, a private investment requires careful analysis of the underlying assets and projected future cash flows.

- Income Streams and Future Projections

Income streams, whether from employment, ventures, or investments, play a pivotal role. Stable, high-value income sources contribute positively to the valuation. Future projections of income, if reliable, add a layer of estimation and potential growth. However, relying solely on projections without verifiable evidence introduces substantial uncertainty. Projected income streams must be approached cautiously and analyzed based on realistic assumptions and market conditions.

- Liabilities and Net Worth Calculation

Liabilities, like debts or outstanding obligations, are subtracted from the total value of assets and income to arrive at net worth. Accurate accounting of these liabilities is crucial. Failure to account for these obligations will overestimate the net worth figure. Complex financial structures, such as multiple business entities or interwoven financial arrangements, demand meticulous accounting of liabilities for accurate valuation.

In summary, accurately assessing Damon Dash's financial standing requires a comprehensive understanding of valuation principles. The valuation process must consider various assets, investments, income streams, and liabilities, employing suitable methodologies for each. Recognizing the limitations of data and estimations is essential for a balanced perspective on the true financial picture. The diverse aspects discussed above highlight the multifaceted nature of determining an individual's financial worth.

6. Estimation

Estimating Damon Dash's net worth is inherently complex due to the lack of readily available, definitive financial information. Publicly disclosed financial data is often incomplete, leaving significant portions of his financial portfolio obscured. Estimates, therefore, represent approximations, requiring careful consideration of the potential inaccuracies inherent in this process. Understanding the methodology and limitations of these estimations is critical for a balanced perspective.

- Data Availability and Accessibility

Limited public financial disclosures, typical for individuals not publicly traded or significantly involved in public markets, restrict accurate valuation. This limited transparency necessitates reliance on publicly accessible information, including financial records, past business ventures, and reported assets. In the absence of complete financial statements, estimations are necessarily approximations.

- Valuation Methodologies

Different valuation methods produce varied estimates. Methods used to estimate Damon Dash's worth might include evaluating comparable business ventures, assessing the market values of his assets (real estate, intellectual property), and projections of future income streams. Significant variations arise based on the chosen methodologies and underlying assumptions. Employing different models might lead to vastly disparate valuation estimates for the same individual, depending on the selection of variables and the inputs used in the calculations.

- Market Conditions and Economic Factors

Fluctuations in market conditions influence the valuation of assets. Economic downturns or shifts in the valuation of specific assets can impact estimated net worth. If Damon Dash has investments in volatile markets, like tech stocks or real estate, these changes would directly affect estimations. Current market values and economic trends should be carefully considered in the estimation process. The choice of metrics influences the estimation.

- Assumptions and Projections

Determining net worth frequently involves making assumptions about future performance and income streams. These projections, often reliant on forecasts and industry insights, can significantly influence estimations. The accuracy of such estimates is heavily dependent on the validity of these assumptions, which can vary and impact the final calculation. Estimating future performance can introduce inaccuracies, as projections inevitably hold some level of uncertainty, impacting the overall net worth estimate.

In conclusion, estimations of Damon Dash's net worth are approximations due to the inherent complexities and limitations of the available data. Different methodologies produce various estimates, highlighting the degree of uncertainty surrounding this valuation process. Understanding these limitations is essential for interpreting any estimation and contextualizing the figure within the broader context of his career, investments, and overall financial standing. No single, definitive estimate captures the true and complete picture.

7. Public Record

The public record plays a crucial role in understanding the factors influencing estimations of Damon Dash's net worth. However, its limitations must be acknowledged. Public records, in most cases, offer only a partial view of an individual's financial position. This partial view arises from the nature of public accessibility, which often restricts the scope of available details, particularly in matters involving privacy and confidentiality.

Public records, when available, can include details like property ownership, business filings, and legal judgments. These provide some insights into assets and potential liabilities. For example, if Damon Dash owns a property, a public record of that ownership will be available. Similarly, business filings, if available, might offer some insight into financial transactions or business structures. However, these records rarely encompass the entire picture. Complex investments, private partnerships, and other forms of wealth not subject to public disclosure might significantly affect the actual net worth, yet remain hidden from public scrutiny.

Furthermore, public record information might not always be readily interpretable. Transactions and ownership records might not reflect real-time value. Market fluctuations, economic conditions, and changes in business ownership can influence the actual worth of assets but are not consistently and comprehensively reflected in public documents. The public record is a necessary tool but an incomplete one, requiring careful consideration to avoid oversimplification and misinterpretation. An accurate assessment of net worth needs more complete financial information than the public record typically provides. Understanding the limitations of the public record is crucial for a realistic and nuanced evaluation. Essentially, the public record offers a starting point for investigation but demands additional exploration to offer a full understanding.

8. Privacy

Privacy considerations are central to determining and discussing net worth, especially when dealing with individuals not in the public eye or those with complex financial structures. The desire for personal financial privacy significantly impacts the availability of verifiable data necessary to calculate precise net worth. This lack of transparency makes estimations, even those performed by professionals, approximations rather than definitive figures.

- Limited Public Information

Publicly available records often provide a limited, incomplete picture of an individual's financial status. While property records and business filings may offer some clues, they typically do not encompass the totality of assets, investments, and liabilities. Private investment portfolios, complex trusts, and other financial arrangements remain hidden from public view, making precise estimations challenging. This lack of full disclosure makes any publicly available figure a potential underestimate.

- Protection of Sensitive Information

Individuals understandably desire privacy regarding their financial details. The value and sensitivity of financial information often necessitate careful handling and protection. This protects from potential misuse or exploitation by various parties. The inherent sensitivity of financial information prompts individuals to exercise caution and limit the public dissemination of financial details. This privacy often acts as a barrier to completely understanding their complete financial standing.

- Complexity of Financial Structures

Complex financial structures, including trusts, holding companies, and layered investment vehicles, can obfuscate the true scope of an individual's assets and liabilities. This intricacy makes it exceedingly difficult to trace ownership, value holdings, and calculate a true net worth, even with access to some public records. The complexity of financial structures themselves creates a barrier to establishing a definitive financial picture. This is particularly true for high-net-worth individuals with multifaceted business ventures.

- Impact on Valuation Estimates

The lack of comprehensive financial disclosure directly impacts the accuracy of valuation estimates. Without full access to details on assets, investments, and liabilities, estimates remain approximations. These estimations inherently contain margins of error that reflect the limitations of incomplete information. This is why precise net worth figures for individuals with a high degree of privacy are often unavailable.

In conclusion, the paramount importance of privacy in financial matters significantly hinders the determination of precise net worth. The limited availability of complete financial data renders exact calculations challenging. This constraint applies to individuals like Damon Dash, who may operate within complex financial structures and desire to maintain a degree of privacy. Any estimate represents an approximation, highlighting the essential role that privacy plays in the broader picture of financial valuation.

Frequently Asked Questions About Damon Dash's Net Worth

Determining precise net worth figures for individuals like Damon Dash is complex. Publicly available information is often limited, necessitating reliance on estimates. The following addresses common questions regarding this topic.

Question 1: How is net worth estimated?

Estimating net worth involves assessing assets, investments, income streams, and liabilities. Methods may include evaluating comparable business ventures, assessing market values of assets (real estate, intellectual property), and projecting future income. However, the lack of complete financial disclosures necessitates reliance on approximations, and different methodologies can yield varied estimates.

Question 2: Why is precise data often unavailable?

Privacy considerations are paramount in financial matters. Individuals may prefer not to disclose extensive financial details to the public. Complex financial structures, including trusts and holding companies, can obscure asset ownership and valuation, making comprehensive data inaccessible. This limits the ability to calculate exact net worth.

Question 3: What role do assets play in determining net worth?

Assets, such as real estate, intellectual property, and investments, contribute significantly to calculating net worth. The market value of these assets fluctuates, impacting the overall estimate. However, valuing certain assets (especially those not publicly traded) presents specific challenges.

Question 4: How do investments influence net worth estimations?

Investments, both public and private, directly affect net worth. Returns on investments and the overall performance of a portfolio are key factors. The valuation of investments, particularly those within complex structures, requires specialized knowledge and potentially, estimation.

Question 5: What about income streams and their impact?

Income streams, from employment, business ventures, or investments, are integral in calculating net worth. Consistent, high-value income sources contribute positively. However, fluctuating income and the presence of various financial obligations can complicate the estimation process.

Question 6: How do liabilities affect net worth figures?

Liabilities, including debts, loans, and other financial obligations, reduce net worth. Accurate accounting of liabilities is critical for a comprehensive estimation. Complex or undisclosed liabilities can introduce significant uncertainty into the assessment.

In summary, determining Damon Dash's net worth involves a complex interplay of assets, investments, income, liabilities, and privacy considerations. Publicly available data is often limited, necessitating reliance on estimations. Different estimation methods can lead to varied results, highlighting the limitations of incomplete information.

The following section will delve into Damon Dash's career and business activities to offer additional context.

Tips for Understanding Net Worth Estimations

Determining the precise net worth of individuals like Damon Dash presents inherent challenges. Publicly available data is often incomplete, necessitating reliance on estimations. These tips offer a framework for approaching such estimations responsibly and critically.

Tip 1: Recognize the Limitations of Public Data. Public records, such as property ownership and business filings, provide a partial picture. Crucially, they often exclude private investments, complex financial structures, and other assets not subject to public disclosure. Estimates must be viewed within this context, acknowledging the incomplete nature of available information.

Tip 2: Evaluate Valuation Methods. Different methodologies for valuing assets yield different estimates. Understanding the methods used in estimationssuch as comparable sales analysis for real estate or discounted cash flow analysis for investmentsis critical for evaluating the validity and potential biases inherent in the calculation. Consider the potential for variations between different estimates.

Tip 3: Scrutinize Reported Income. Analyze the consistency and sources of reported income. Stable, high-value income sources contribute positively to net worth estimations, but unreliable or fluctuating income streams require careful assessment. Scrutinize the frequency, regularity, and provenance of income figures to gauge the reliability of estimations.

Tip 4: Analyze Liabilities with Caution. Liabilities, such as debts and financial obligations, significantly reduce net worth. Assess the type and amount of liabilities, ensuring accurate inclusion in any estimation. Thorough accounting is crucial, and an absence of complete disclosure might lead to underestimation of liabilities and an overstatement of net worth.

Tip 5: Consider Market Fluctuations. Market conditions directly influence the value of assets. Real-time market values and economic trends affect investment portfolios. Understanding these fluctuations is crucial when assessing estimated net worth, acknowledging the potential impact of market volatility on valuations.

Tip 6: Seek Professional Expertise When Needed. For complex financial situations, consulting a financial professional can offer more insight. Expert analysis can illuminate the nuances of financial structures, assist in valuing complex assets, and assess liabilities. Professional expertise can often provide a more accurate picture than relying solely on publicly available information.

Tip 7: Understand the Concept of Estimation. Estimates of net worth are fundamentally approximations. Acknowledging the inherent uncertainty in these estimations is essential for realistic evaluation. Avoid viewing estimations as definitive figures and recognize their inherent limitations.

By applying these tips, individuals can approach estimations of net worth with a more informed and critical perspective. A comprehensive understanding of the limitations and complexities inherent in these estimates is crucial for responsible interpretation.

The next section will provide a summary of Damon Dash's career and endeavors.

Conclusion

Determining a precise figure for Damon Dash's net worth proves challenging due to the complexities of valuing assets, investments, and liabilities. Publicly available financial data is often incomplete, necessitating reliance on estimates. These estimations, while offering insights, remain approximations rather than definitive figures. The analysis highlighted the multifaceted nature of financial valuation, requiring a thorough understanding of various asset types, investment performance, income streams, and outstanding debts. Factors like market fluctuations, economic conditions, and the inherent complexities of private investment structures further complicate the calculation. The lack of complete financial disclosure necessitates caution in interpreting any estimate and underscores the limitations of publicly available information.

The exploration of Damon Dash's financial situation serves as a case study illustrating the challenges inherent in assessing the wealth of individuals with complex financial portfolios and a preference for privacy. The process emphasizes the importance of critical evaluation of any financial estimations. While the pursuit of precise financial figures can be valuable for investment analysis and market trends, it is essential to approach such estimations with an awareness of their limitations and inherent uncertainties. Future analyses might benefit from greater transparency in financial reporting, thereby improving the accuracy of such estimations.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaKuklr%2B0ecOiqpyto6i2r7OMsKaro12htqexjqGmsGWdqrCpecisZJ2ZnaS7brDArJ9mr5%2Bnwal6x62kpQ%3D%3D