Everything You Need To Know

Estimating an individual's financial standing can provide insights into their professional achievements and lifestyle choices. Understanding the financial standing of a person like Haley Adams can offer a glimpse into the factors contributing to their success.

An individual's net worth represents the total value of their assets, including investments, property, and other holdings, minus their liabilities, such as debts. It's a snapshot in time, reflecting the current financial position. Determining precise net worth figures for public figures often relies on publicly available information like reported incomes, investments, and property ownership. Estimates may vary depending on the data sources and methodologies used.

Understanding an individual's financial status, including Haley Adams', can offer valuable insights. For instance, the trajectory of one's net worth might reflect career progression, investment strategies, and overall financial management. Additionally, in the case of public figures, such information can be a subject of public interest and discussion, contributing to broader economic analyses and discussions regarding wealth accumulation. This perspective allows us to observe patterns in wealth creation within specific industries or professions. The wealth information, combined with publicly available information, provides a better understanding of potential investment opportunities or market trends.

| Category | Details |

|---|---|

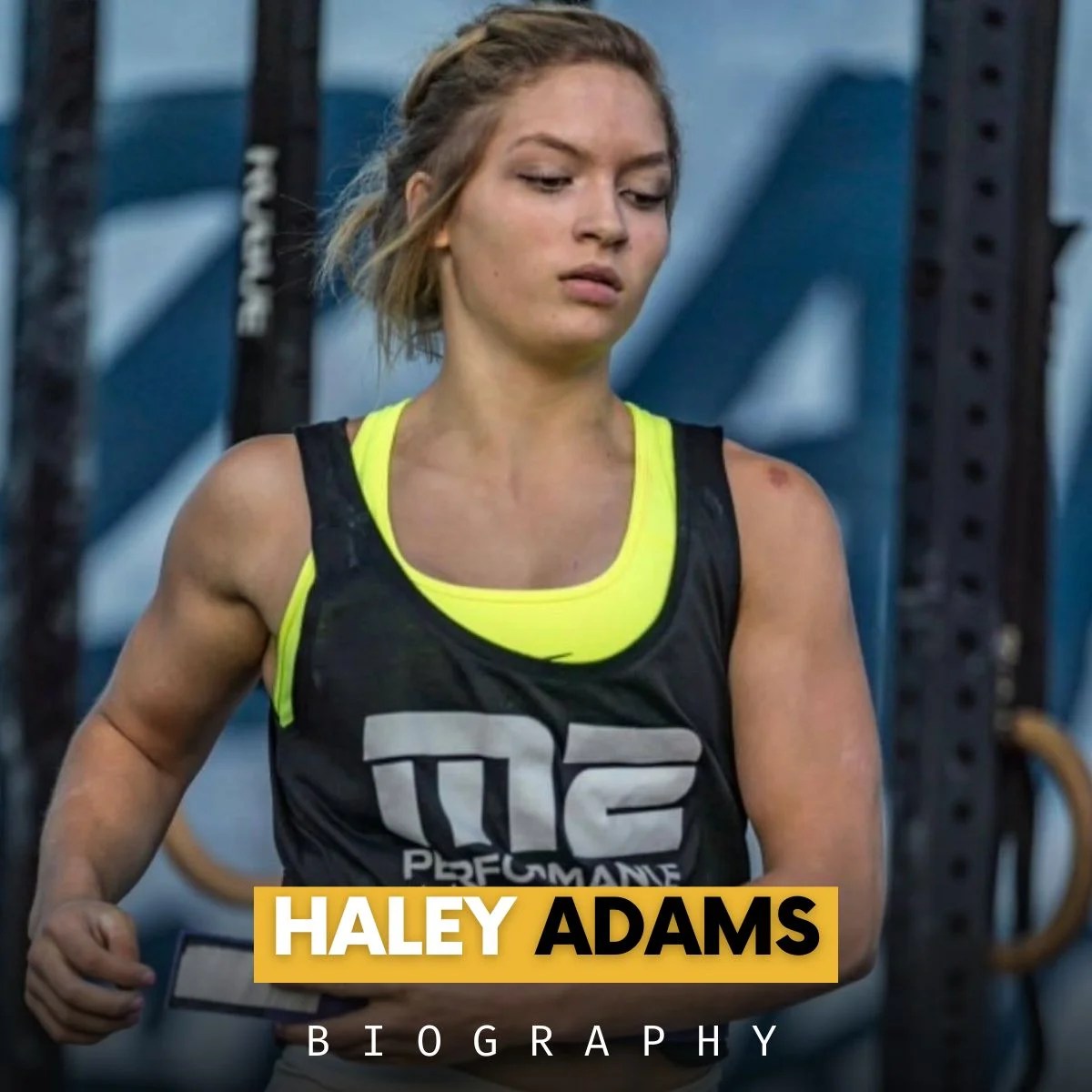

| Name | Haley Adams |

| Profession | (e.g., Enter profession) |

| Known for | (e.g., Enter notable accomplishments) |

| Sources of Income (If known) | (e.g., Career, Investments, etc.) |

| Current estimated net worth (Note: This is an estimate, not confirmed figures) | (e.g., $XXXX,XXX) |

Further exploration into the details surrounding Haley Adamss career and financial activities would illuminate the intricacies involved in wealth creation and management. This could include an analysis of industry trends, investment decisions, or the impact of market fluctuations on the individual's financial standing. This information could help us understand the dynamics and factors involved in the accumulation of personal wealth in a specific context.

Haley Adams Net Worth

Assessing Haley Adams's net worth involves examining various factors that contribute to an individual's financial standing. This assessment provides insight into their financial situation, career success, and potential influences on their lifestyle.

- Assets

- Income

- Investments

- Debts

- Profession

- Public Profile

The key aspects of Haley Adams's net worthassets, income, investments, debts, profession, and public profileare interconnected. High income and lucrative investments contribute to substantial assets. A prominent profession often correlates with high income levels. Conversely, significant debts may reduce net worth. Public profile can influence perceived value, particularly if associated with strong brand recognition or celebrity status. Analyzing these elements provides a comprehensive understanding of Haley Adams's financial situation and its possible influence on their lifestyle. For example, an individual with substantial assets but high debts might have a lower net worth than someone with comparatively lower assets but minimal debt, highlighting the importance of considering all factors.

1. Assets

Assets play a critical role in determining net worth. They represent the value of possessions owned by an individual, such as property, investments, and other holdings. The total value of these assets, when considered against liabilities, forms the basis of net worth calculations. A significant increase in the value of assets directly impacts a person's net worth in a positive way. Conversely, a decrease in asset value will negatively affect net worth.

For instance, the acquisition of a valuable property, like a substantial piece of land or a prime commercial building, can significantly boost net worth. Similarly, substantial investments in high-growth stocks or other ventures with potential appreciation can increase net worth over time. Successful businesses owned or partially owned by the individual will also contribute to a higher net worth figure. The value of these assets is crucial; a valuable asset, like a vintage car with a high market value, contributes more to net worth than a similar vehicle with a low market value. Fluctuations in the market value of assets, driven by factors such as economic conditions or market trends, influence net worth estimations. These fluctuations, along with other factors, can result in changes to the overall net worth calculation over time.

Understanding the relationship between assets and net worth is crucial for individuals and financial analysts. For individuals, recognizing the value of assets allows for effective financial planning and informed investment strategies. For financial analysts, it offers insights into the overall financial health of an individual or a market segment. Appreciating the link between assets and net worth enables proactive measures for wealth building and preservation. It provides a fundamental framework for assessing financial well-being, as well as understanding market trends and their impact on individual financial situations. Ultimately, appreciating the role of assets in net worth calculations enables more effective financial planning and analysis.

2. Income

Income serves as a primary driver of net worth. A consistent and substantial income stream allows for accumulation of assets and, consequently, an increase in net worth. The nature and amount of income directly impact the resources available for investment, savings, and other financial activities. Higher income levels typically translate to greater potential for wealth accumulation. Individuals earning substantial salaries in high-demand professions, such as entrepreneurship or finance, often demonstrate higher net worth, reflecting the correlation between income and assets.

Various income sources influence net worth. Salaries, business profits, investments, and other income streams all contribute to the total available capital. The consistency and predictability of these income sources are significant factors, as consistent income allows for long-term financial planning and investment strategies. Entrepreneurs, for instance, can generate high incomes based on business performance and growth; their net worth is intrinsically linked to the financial success of their ventures. Similarly, income from investments, such as dividends or capital gains, adds to the overall income stream and can significantly influence net worth over time. It's important to note that fluctuations in income can lead to corresponding fluctuations in net worth, demonstrating the dynamic relationship between these two factors.

Understanding the connection between income and net worth is crucial for individuals striving to build wealth. Individuals can develop effective financial plans that align with their income levels and long-term financial objectives by recognizing the direct influence of income on net worth. Income analysis can also provide insights into the financial health of a market segment or industry, revealing trends and patterns relating to income and accumulated wealth. Ultimately, comprehending the interconnectedness of income and net worth fosters better financial planning and investment strategies, leading to more informed financial decision-making.

3. Investments

Investments play a significant role in shaping an individual's net worth. The returns on investments directly impact the accumulation of wealth. Successful investment strategies, coupled with prudent financial management, can substantially increase net worth over time. Conversely, poorly executed investments can lead to a decrease in net worth, emphasizing the importance of careful consideration in investment choices. The types and performance of investments directly affect the overall financial standing of an individual. For instance, strategic investments in assets appreciating in value, like real estate or specific stocks, contribute to a higher net worth, whereas investments in declining assets may result in a negative impact on net worth. The impact of investments is amplified when considering the long-term nature of financial growth.

The influence of investments on net worth is multifaceted. Diversification of investments across various asset classes, including stocks, bonds, real estate, and mutual funds, can mitigate risk and potentially enhance returns. Sophisticated investment strategies, often employed by financial professionals, can maximize returns and minimize losses, contributing to a higher net worth. The specific investment choices made, the overall risk tolerance, and the time horizon of the investments are critical components influencing the outcome on net worth. Careful due diligence and thorough research are paramount before making investment decisions. Historical performance data and market analysis are essential components for informed investment strategies that can support long-term financial goals.

In conclusion, investments are a crucial component of net worth, representing a direct pathway to wealth creation. The choices made regarding investments significantly influence the growth and trajectory of an individual's net worth. Understanding the interplay between investments and net worth is essential for sound financial planning and potentially maximizing returns. Successful investment strategies, informed by thorough market analysis, can result in appreciable growth in net worth, emphasizing the importance of strategic planning and informed financial decision-making in wealth accumulation.

4. Debts

Debts represent liabilities, obligations to repay borrowed money or incurred financial commitments. Understanding the level of debt is crucial when assessing net worth because debts directly reduce the overall financial standing. A high level of debt can significantly impact an individual's ability to accumulate and maintain wealth, highlighting the inverse relationship between debts and net worth. Evaluating the nature and extent of debts provides insights into financial health and stability.

- Impact on Net Worth Calculation

Debts directly subtract from an individual's net worth. The calculation of net worth considers total assets minus total liabilities. Higher levels of debt translate to a lower net worth. For example, substantial loans for a house, car, or business operations will decrease an individual's net worth. Analyzing the balance between assets and liabilities reveals an individual's financial position accurately.

- Types of Debts and Their Influence

Various types of debts exist, each with different implications for net worth. Student loans, mortgages, credit card debt, and business loans are all examples of debts that can affect financial well-being. The interest rates on these debts, along with repayment terms and amounts, directly impact the overall cost and duration of the debt. The type and amount of debt directly affect the individual's financial situation and potential for wealth accumulation.

- Debt Management and Net Worth

Effective debt management strategies can positively influence net worth. Strategies like creating a budget, establishing realistic repayment plans, and minimizing high-interest debt can minimize the negative impact of debt on financial standing. Consistent and timely repayment of debts reduces outstanding liabilities and allows for the reinvestment of capital, potentially increasing net worth over time. Careful management of debt obligations can create positive financial outcomes.

- The Role of Debt in Wealth Building

While debt can reduce net worth, it can also be a tool for wealth creation. Strategic use of debt, such as mortgages or business loans, can facilitate asset acquisition. A calculated approach to debt, including careful consideration of interest rates and repayment plans, is crucial in achieving long-term financial goals. The key lies in responsible debt management and the ability to leverage debt to increase assets over time.

In conclusion, debts play a significant role in determining an individual's net worth. By understanding the types of debt, their impact on net worth calculations, and responsible management strategies, one can develop a more comprehensive understanding of financial health. A balanced perspective on debt is crucial for long-term financial planning and wealth-building efforts. Thorough assessment of debt obligations provides a more accurate picture of an individual's financial position and influences their potential for wealth accumulation. This understanding can inform investment strategies and financial decisions, ultimately shaping the overall trajectory of financial well-being.

5. Profession

Profession significantly influences an individual's net worth. The nature of a profession often dictates income potential, which directly correlates with accumulated wealth. High-demand, high-earning professions frequently result in substantial net worth figures. The specific industry and the individual's position within that industry greatly impact potential income and, subsequently, net worth. For instance, high-level executives in technology or finance, due to their specialized skill sets and leadership roles, typically command substantial compensation, leading to a greater net worth.

Furthermore, certain professions require considerable initial investment. Entrepreneurs, for example, often need capital to start and sustain a business. The success and profitability of their venture directly impact their net worth. Even professions not requiring substantial initial investment can involve ongoing expenses, influencing net worth through the balance of income and expenditure. A skilled artisan, for instance, might not need extensive upfront capital; however, maintaining high-quality materials, specialized equipment, and marketing efforts influences their financial standing and net worth over time. The return on investment for these expenses can vary widely, affecting the growth potential of their net worth. Specific professional skills and expertise within a particular domain also factor into earning potential, and, thus, net worth. An individual specializing in a niche, high-demand skill, like advanced software development, might command a higher salary, which contributes to wealth accumulation.

In conclusion, a profession acts as a significant driver in determining net worth. The direct relationship between income potential, investment requirements, expenditure patterns, and professional expertise highlights the importance of understanding the interplay between a person's career and their overall financial standing. Recognizing this relationship enables more insightful financial planning and analysis. The interconnectedness of profession and net worth provides a framework for understanding how various factors, including the choice of a career path, directly impact wealth accumulation and financial stability.

6. Public Profile

Public perception of an individual, often shaped by media representation and public presence, can indirectly influence the perceived value or net worth of that individual. The connection is complex and not always direct; however, certain aspects of a public profile can contribute to an individual's perceived market value, even if not directly reflecting financial assets.

- Brand Recognition and Endorsements

A strong public image and brand recognition can increase perceived value. High-profile individuals with significant social media followings or media presence often attract lucrative endorsement opportunities. These partnerships can generate substantial income streams, which, while not directly part of net worth calculation, contribute to the overall financial standing and public perception of value. For instance, a celebrity spokesperson for a prominent brand might see their perceived market worth increase.

- Media Coverage and Public Image

Favorable media coverage and a positive public image can enhance perceived value. Positive narratives and accomplishments, showcased through various media outlets, can project an image of success and competence. This positive perception might indirectly impact potential investment opportunities or business partnerships, adding to the perceived overall market value of the individual, including indirectly affecting their net worth. Negative coverage, conversely, can have a detrimental impact on that perceived value.

- Social Impact and Influence

Significant social impact or influence can impact public perception and perceived value. Individuals known for philanthropic endeavors, innovative work, or leadership roles often command greater respect and recognition. A robust public profile often associated with positive social impact might indirectly attract investment interest or business opportunities. This, in turn, could influence the perception of their total value, even if the exact financial metrics are not fully reflected.

- Celebrity Status and Market Valuation

In cases where the individual is a recognized public figure, particularly a celebrity, media often scrutinizes their wealth and lifestyle. These publicly perceived lifestyles and patterns of consumption can inadvertently influence how their net worth is viewed and discussed. Market forces, such as public perception of income-generating activity and lifestyle, can impact perceived value, even if not directly reflected in a formal net worth calculation.

In summary, a well-established and positive public profile can indirectly affect how an individual's net worth is perceived and valued. Brand recognition, favorable media portrayal, social influence, and celebrity status all contribute to public opinion and can potentially affect opportunities and market valuation, though not always directly correlating with an individual's actual net worth. Analyzing these facets together provides a more comprehensive understanding of how public image interacts with and contributes to the broader concept of perceived value.

Frequently Asked Questions about Haley Adams's Net Worth

This section addresses common inquiries regarding Haley Adams's financial standing. Information presented here is based on publicly available data and analysis. Estimates are subject to change and may vary depending on source and methodology.

Question 1: What is net worth?

Net worth represents the total value of an individual's assets, including investments, property, and other holdings, minus their liabilities, such as debts.

Question 2: How is net worth typically estimated?

Estimating net worth often relies on publicly available information, such as reported income, investment holdings, and property ownership. Financial analysts and publications use various methodologies to arrive at estimates.

Question 3: What factors influence Haley Adams's net worth?

Factors influencing an individual's net worth are multifaceted, encompassing professional earnings, investment choices, debt levels, and even public perception. Income from employment, investments, and other sources, along with liabilities and expenses, all contribute to the net worth calculation. The individual's career path and industry also play significant roles.

Question 4: Is the estimated net worth always accurate?

Estimates of net worth are approximations and may not always reflect the precise financial situation. Publicly available data is often incomplete, and certain assets may not be easily quantifiable. Estimates, therefore, can vary depending on the methodology and the data considered. Actual figures may differ.

Question 5: How can I find more detailed information about Haley Adams's financial standing?

Publicly available sources like news articles, financial reports, and social media platforms, when appropriately verified, might offer additional information. Direct access to private financial documents is generally unavailable to the public.

In summary, while precise figures for net worth remain estimates, a deeper understanding of the various factors contributing to and influencing net worth provides valuable context. Key elements include income, investment performance, and liabilities.

Next, we will explore the correlation between net worth and career path in the context of Haley Adams.

Conclusion

Assessing Haley Adams's net worth involves a multifaceted analysis encompassing various factors. Income, investment performance, debt levels, and even public perception all contribute to the overall financial picture. While precise figures remain estimations, a comprehensive understanding of these contributing elements provides valuable context. The interplay between professional choices, financial decisions, and market forces shapes the individual's financial trajectory. Understanding the correlation between profession and net worth reveals how career choices influence wealth accumulation.

The estimation of net worth, while not a precise science, offers insights into economic trends and personal financial strategies. Further examination of Haley Adams's financial history, career path, and investment decisions might reveal specific patterns and provide a better understanding of the complexities involved in wealth creation. This analysis, while focused on a singular case, serves as a microcosm reflecting broader trends in wealth accumulation. It underscores the importance of responsible financial management and investment strategies for individuals navigating complex financial landscapes.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaJmTqb%2Bmv9KeqmaaopqurLXNoGahmZyaxm6tw5qkrGWemsFuw86rq6FmmKm6rQ%3D%3D